While everybody is posting their own end-of-the-year list, here’s my selection of ethical stand-outs.

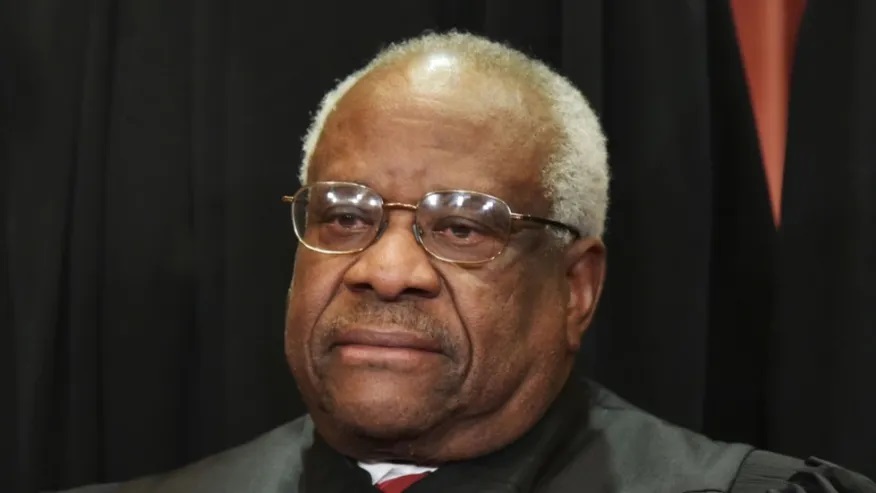

Mike Carey –

Carey is the first African-American to referee the Super Bowl and has been honored as one of the best in the game in 2008. While honesty and fairness are critical to his job, so is respect. So, in 2006 Carey quietly requested that he no longer officiate games for Washington’s NFL team which continues to use a dictionary-defined racial slur as its nickname.

“I’ve called them Washington all my life,” Carey said. “And I will continue to call them Washington. The league respectfully honored my request not to officiate Washington.”

As the Washington Post reported (Aug. 20),”For almost all of the final eight seasons and 146 games of Carey’s career… [he] essentially told his employers his desire for a mutually respectful society was so jeopardized by Washington’s team name that he could not bring himself to officiate the games of owner Daniel Snyder’s team.

“ ‘It just became clear to me that to be in the middle of the field, where something disrespectful is happening, was probably not the best thing for me,’ Carey said.

“Told how uncommon his social stance was for a referee, whose primary professional goal is to be unbiased, Carey shook his head. ‘Human beings take social stances,’ he said. ‘And if you’re respectful of all human beings, you have to decide what you’re going to do and why you’re going to do it.’ ”

“ ‘I did not know about Mike Carey, why he didn’t do Washington games,’ John Wooten, chairman of the Fritz Pollard Alliance, said late Tuesday night by telephone from his home in Arlington, Tex. ‘This shows you the kind of person he is. He is an outstanding man of character.’

“ ‘I know that if a team had a derogatory name for African Americans,’ Carey said, ‘I would help those who helped extinguish that name. I have quite a few friends who are Native Americans. And even if I didn’t have Native American friends, the name of the team is disrespectful.’ ”

Cameron Tringale –

Golf has always had its storied heroes of honesty as far back as Bobby Jones, and American golfer Cameron Tringale is another name to add to that list.

In a story reported by the PGA (Aug. 16), Tringale essentially disqualified himself after the final round of the 96th PGA Championship at Valhalla Golf Club. In a statement, the young golfer said,

“I have contacted the PGA of America and asked to be disqualified from last week’s PGA Championship at Valhalla,” Tringale said. “On Sunday, I signed for a bogey 4 on the par-3 11th hole. While approaching the hole to tap in my three-inch bogey putt, the putter swung over the ball prior to tapping in. Realizing that there could be the slightest doubt that the swing over the ball should have been recorded as a stroke, I spoke with the PGA of America and shared with them my conclusion that the stroke should have been recorded. I regret any inconvenience this has caused the PGA of America and my fellow competitors in what was a wonderful championship.”

“Consequently” the PGA says, “Tringale, who finished T-33 last week, will forfeit his PGA Championship prize money and all those players finishing below him will be elevated in the final prize money standings. This will not affect the Ryder Cup Team makeup or order of final point standings.

“ ‘We are very appreciative of Cameron coming forward to inform us of this situation,’ PGA of America Chief Championships Officer Kerry Haigh said. ‘It yet again shows the great values and traditions of the game and the honesty and integrity of its competitors.’ ”

Bill Lloyd –

As reported in an Op-Ed in the New York Times by columnist Joe Nocera (Aug. 16), “Late last month, the Securities and Exchange Commission issued an oblique press release announcing that it was awarding an unnamed whistle-blower $400,000 for helping expose a financial fraud at an unnamed company. …

“His name is Bill Lloyd. He is 56 years old, and he spent 22 years as an agent for MassMutual Financial Group, the insurance company based in Springfield, Mass. Although companies often label whistle-blowers as disgruntled employees, Lloyd didn’t fit that category. On the contrary, he liked working for MassMutual, and he was a high performer. He also is a straight arrow — ‘a square,’ said the mutual friend who introduced us — who cares about his customers; when faced with a situation where his customers were likely to get ripped off, he couldn’t look the other way.

“In September 2007, at a time when money was gushing into variable annuities, MassMutual added two income guarantees to make a few of its annuity products especially attractive to investors. Called Guaranteed Income Benefit Plus 6 and Guaranteed Income Benefit Plus 5, they guaranteed that the annuity income stream would grow to a predetermined cap regardless of how the investment itself performed.

“Then, upon retirement, the investors had the right to take 6 percent (or 5 percent, depending on the product) of the cap for as long as they wanted or until it ran out of money, and still be able, at some point, to annuitize it. It is complicated, but the point is that thanks to the guarantee, the money was never supposed to run out. That is what the prospectus said, and it is what those in the sales force, made up of people like Lloyd, were taught to sell to customers. It wasn’t long before investors had put $2.5 billion into the products.

“The following July, Lloyd — and a handful of others in the sales force — discovered, to their horror, that the guarantee didn’t work as advertised. In fact, because of the market’s fall, it was a near-certainty that thousands of customers were going to run through the income stream within seven or eight years of withdrawing money.

“Lloyd did not immediately run to the S.E.C. Rather, he dug in at MassMutual and, as the S.E.C. press release put it, did “everything feasible to correct the issue internally.” For a while, he thought he was going to have success, but, at a certain point, someone stole the files he had put together on the matter and turned them over to the Financial Industry Regulatory Authority, which is the industry’s self-regulatory body. It was only when the regulatory authority failed to act that his lawyer told him about the whistle-blower provisions in Dodd-Frank and he went to the S.E.C., which began its own investigation.

“In November 2012, MassMutual agreed to pay a $1.6 million fine; Lloyd’s $400,000 award is 25 percent of that. It was a slap on the wrist, but more important, the company agreed to lift the cap. This will cost MassMutual a lot more, but it will protect the investors who put their money — and their retirement hopes — on MassMutual’s guarantees. Thanks to Lloyd, the company has fixed the defect without a single investor losing a penny.”

Derek Jeter –

As reported on the web site Ethics Alarms written by Jack Marshall (Sept. 26), “Last night, at the age of 40, [Derek Jeter] played his final home game at the position for the Yankees. His career statistics show no batting or home run titles, it is true, but shine brilliantly nonetheless: a .309 lifetime average, 3461 hits (3000 makes a player a lock for the Hall of Fame even if he doesn’t play the most difficult position on the field, as Jeter has ), just short of 2000 runs scored (10th all-time), twelve All-Star games, five Golden Gloves (as the American League’s best fielding shortstop), five Silver Sluggers (as the best hitter at his position), and most of all, seven World Series, five of them on World Champions.

“Apart from the stats, awards and titles, Jeter was just as exemplary. He played in an era when it is impossible to hide as a celebrity: if you are a jerk, everyone will know it. He wasn’t a jerk. He was, in fact, the personification of the perfect sports hero. Jeter has been a leader and teacher by example to his team mates and his admirers, though his one-time friend, Rodriguez, would not absorb the lessons. He has had no personal drama, no tawdry sexual episodes, no bastard children. He was never arrested or suspected of using drugs, performance-enhancing or recreational. There were no DUI charges or petulant interviews. Derek Jeter never had to ask ‘Do you know who I am?’ because he never acted as if he was special, because he made himself special by never acting that way, and because everyone did know who he was. In every way imaginable, from his public comportment to his ability to rise to the occasion under the pressure of a national audience, a rich contract and the hopes of millions, Derek Jeter has embodied the ideal of the athletic hero.

“In so doing,” Marshall writes, “he became the face, not just of his team, but of his sport. There is no obvious successor to Jeter waiting in the national stage wings: what he did, and the way he did it, is incredibly hard, though he always made it look easy. In a sport, the only sport, where so often games come down to whether a single player in the spotlight comes through like Roy Hobbs or fails like Mighty Casey, Jeter came through with routine, indeed annoying, predictability. His specialty was not the game-winning home run, though he hit those too, but the shocking improvised game-saving fielding play, and the chip-shot blooped to the opposite field at the perfect moment, scoring the game-tying or winning run with two outs and a Yankee defeat looming.

“As a Boston Red Sox fan,” Marshall adds, “I hated Jeter for those hits—still do, a little—and that one flaw, that he radiated confidence to the point of smugness. Jeter never boasted out loud, mind you—he just looked, to my eye, as if he knew he was good enough prevail. As Dizzy Dean famously said, ‘If you can do it, it ain’t boasting.’ Jeter was as good as that constant sly smile suggested.”

Tomorrow: My Choice for Person of the Year

Comments