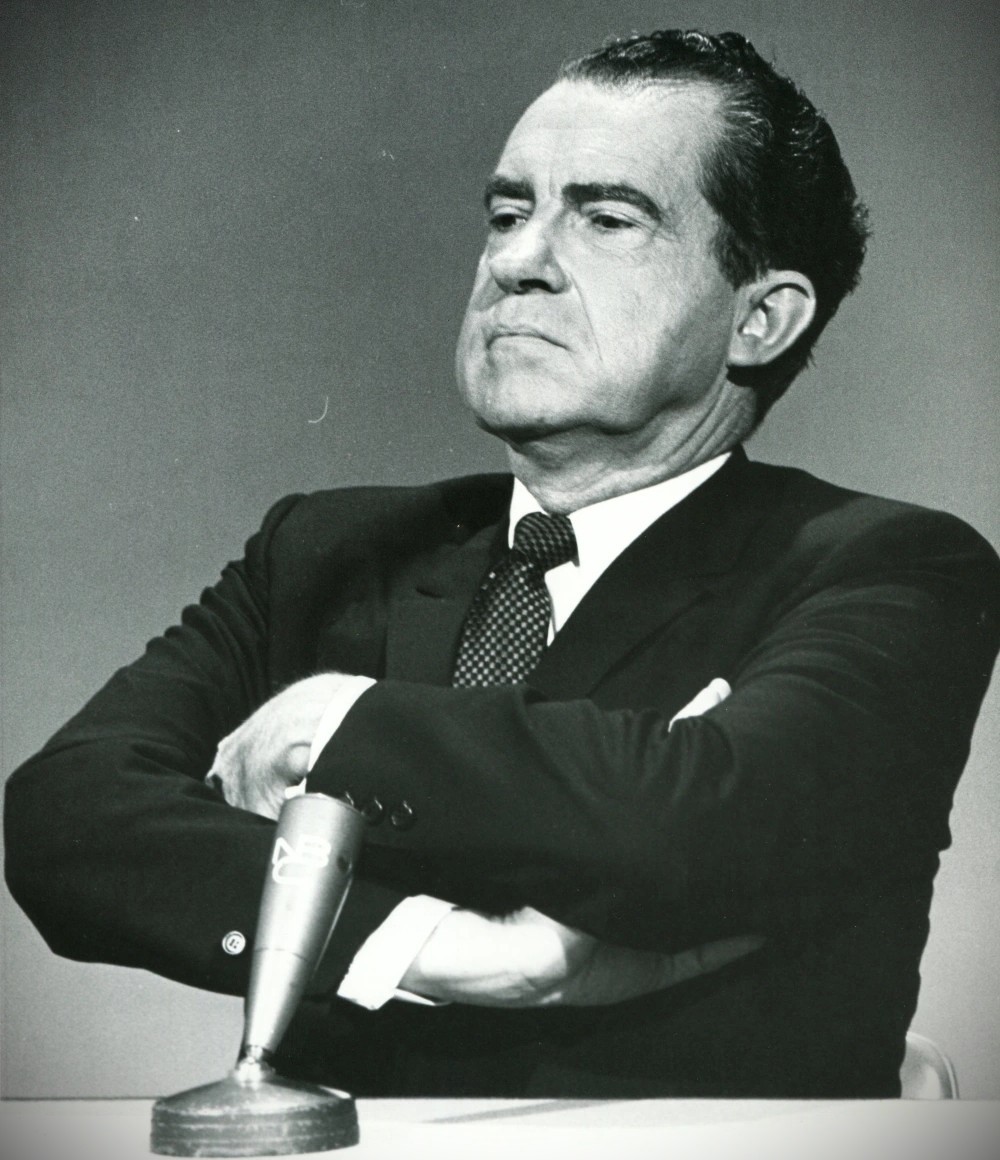

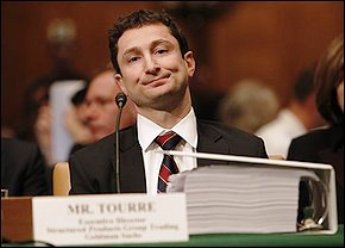

You’d look like this too, if you had to sit before Chairman Carl Levin and the Senate’s Permanent Subcommittee on Investigations looking into alleged improprieties of investments and investment procedures by Wall Street banking and investment giant Goldman Sachs. Get a load of the document bundle sitting in front of (self-named) “Fabulous Fab” Fabrice Tourre, the architect of the investment vehicle under SEC scrutiny.

Trying to understand the Goldman executive’s explanations of these high-level security instruments reminded me of the Gary Larson cartoon: “What We Say to Dogs, ‘Okay, Ginger, I’ve had it! You stay out of the garbage! Okay, Ginger, or else!’; and “What Dogs Hear: “blah, blah, Ginger blah, blah, blah, blah, Ginger, blah, blah!”

Here are some of my notes from yesterday’s marathon session that wrapped up around 5:45pm (PST):

Chairman Levin: “Goldman often saw its clients not as customers but as objects of profit.”

Sen. Claire McCaskill: “You all are the house, you’re the bookie… [Clients] “are booking their bets with you. I don’t know why we need to dress it up. It’s a bet…You have less oversight than a pit boss in Las Vegas.”

Sen. Susan Collins: “Do you have the duty to act in the best interests of your clients?”

Fabrice Tourre: “I believe I have a duty to serve my clients.”

When faced with a series of questions about e-mails, financial products and decision-making, many of the questions by committee members were met with responses like these:

“I don’t know,” “I did not participate in those deals,” “I don’t recall,” or “I left to spend more time with my family.”

The only excuse not used: “The dog ate my investment guidelines!”

In the afternoon session, Senator Mark Pryer said, “I’m going to ask all of you the same question: Do you think your actions and Goldman’s actions contributed to the economic downturn in 2008?”

Each of the four, former Goldman officials believed that they did nothing wrong. However, former Goldman executive Dan Sparks said that it sounded like Pryor was asking him if he had any regrets, and said: “Regret to me is when you feel bad about something you did wrong and I don’t feel that. We made mistakes.”

Pryor persisted, “Did Goldman contribute to the downturn?”

“I don’t know, Sparks said. “I would like to think about that.” A little more thinking and Sparks added, “It’s clear that credit standards overall got loose,” he said. “Too loose. There were assumptions made and I think risk overall wasn’t respected across the industry and we participated in that industry. I’m not trying to avoid your question, senator. I mentioned my feelings about what I did and I don’t have regrets…But we participated in an industry that got loose.”

I lost count of the times the words ethics, ethical standards or code of ethics came up, but not a single Goldman executive was willing to clarify exactly what those standards are.

Here are some of the questions I would have asked:

1. Could you tell us about Goldman’s ethics training?

2. Could you offer an example where you utilized Goldman’sethical standards?

3. Could you explain how any Goldman manager utilized ethical decision-making in selling financial products?

4. In light of the financial crisis, what kinds of changes toGoldman’s ethics policy would you recommend?

At the end of the hearing Goldman CEO Lloyd Blankfein made clear, “Our client’s trust is not only important to us, it is essential to us.”

My question for Mr. Blankfein: How do you maintain that trust in “an industry that got loose,” and a firm that “made some poor business decisions,” as Sparks said earlier.

I don’t mind people making money, even making a lot of money. I draw the line at making any money on the backs of hardworking investors who ended up losing billions.

Anyone out there who does not think that Wall Street is overdue for major regulatory overall please send me your reasoning. I’ll post your comments.

Comments