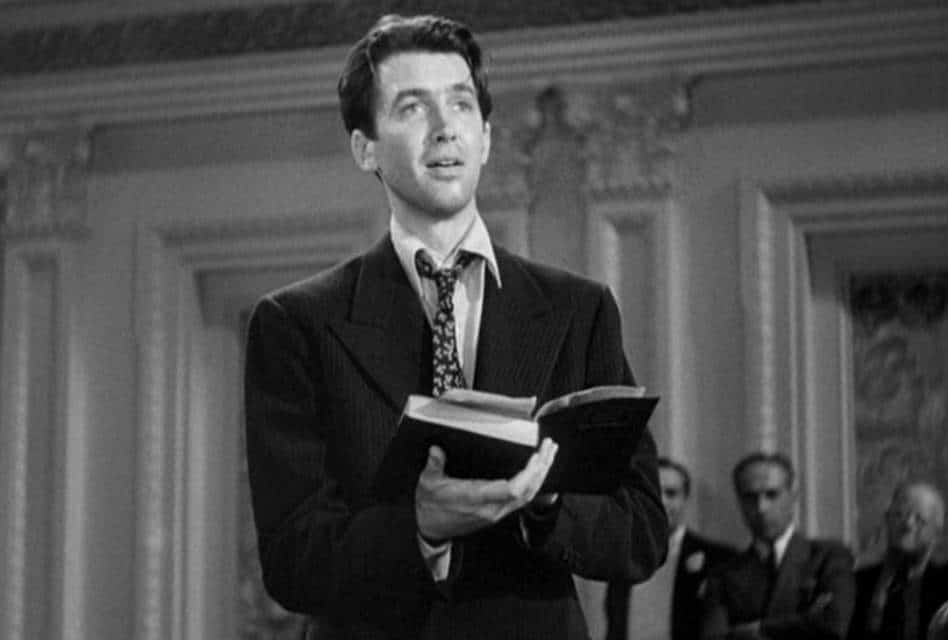

“Those of us who have looked to the self-interest of lending institutions to protect shareholders’ equity, myself included, are in a state of shocked disbelief.”

So said a somber-faced (but he always looks that way) Alan Greenspan as he testified before the House Committee on Oversight and Government Reform.

Remind you of anyone?

Now I’m not suggesting that the former Fed Chair was on the take, but it doesn’t take financial genius to find other parallels in the scheme of the century.

According to a New York Times piece (Oct. 24), “Critics, including many economists, now blame the former Fed Chair for the financial crisis that is tipping the economy into a potentially deep recession. Mr. Greenspan’s critics say that he encouraged the bubble in housing prices by keeping interest rates too low for too long…”

But there’s plenty of blame to go around. In a piece I wrote (The Subprime Inheritance, May 19) I quoted Forbes writer Eric Petroff “…lenders …lent funds to people with poor credit and high risk of default… When the central banks flooded the markets with capital liquidity, it not only lowered interest rates, it also broadly depressed risk premiums as investors sought riskier opportunities to bolster their investment returns.

“…there was an increased demand for mortgages, and housing prices were increasing because interest rates had dropped substantially. At the time, lenders probably saw subprime mortgages as less of a risk than they really were: rates were low, the economy was healthy and people were making their payments.”

In other words, everyone was happy as long as they were collecting their fees, getting their loans, and making money. And when the gravy train ran out of gravy… well, we’re all paying for it now.

At the time, “Mr. Greenspan, along with most other banking regulators… resisted calls for tighter regulation of subprime mortgages and other high-risk exotic mortgages that allowed people to borrow far more than they could afford.”

Sitting in the hot seat, yesterday, before the formidable Chairman Henry Waxman, “…a humbled Mr. Greenspan admitted that he had put too much faith in the self-correcting power of free markets and had failed to anticipate the self-destructive power of wanton mortgage lending.”

But, Wax pressed, “You had the authority to prevent irresponsible lending practices that led to the subprime mortgage crisis. You were advised to do so by many others. Do you feel that your ideology pushed you to make decisions that you wish you had not made?”

“Yes,” Greenspan acknowledged, “I’ve found a flaw. I don’t know how significant or permanent it is. But I’ve been very distressed by that fact.”

Although he refused to take the blame for the meltdown he acknowledged “…that the immense and largely unregulated business of spreading financial risk widely, through the use of exotic financial instruments called derivatives, had gotten out of control and had added to the havoc of today’s crisis. As far back as 1994, Mr. Greenspan staunchly and successfully opposed tougher regulation on derivatives.”

Today, he concedes an error in that thinking. But he does offer one regulatory solution: “that companies selling mortgage-backed securities be required to hold a significant number themselves.”

And what about the mess we’re now in?

“Whatever regulatory changes are made, they will pale in comparison to the change already evident in today’s markets,” Greenspan said. “Those markets for an indefinite future will be far more restrained than would any currently contemplated new regulatory regime.”

Translation: It will be a long, cold night for all of us for some time to come.

How long before we implicitly trust any financial genius? It will be a much longer, colder night.

Comments