Like many, I’ve been frustrated and confused by all the talk about health care costs and reform. (I recently changed my insurance plan from a low deductible to one three times higher in order to save $7,400 over a year.) While The Affordable Care Act has been signed into law, the component that establishes affordable insurance exchanges is not due to take effect until January 2014.

In the meantime, insurance companies are actively engaged in lobbying Congress to repeal the law by reaching out to citizens in a variety of ads.

Writing for The Center for Public Integrity, Wendell Potter points out that “A key component of the industry’s ongoing campaign to convince lawmakers to gut the law is to convinceus that they’re barely making ends meet. And for that they’ve enlisted the help of one of Washington’s pre-eminent spin doctors, Rick Berman.

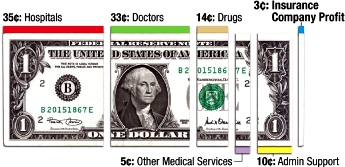

“One of Berman’s industry-funded front groups, The Employment Policies Institute, is behind the D.C. subway ads featuring a dollar bill divided into segments that, we are asked to believe, reveals how insurance companies really spend our premiums (35 cents to hospitals, 33 cents to doctors, 14 cents for drugs, etc.). The five words above the dollar: ‘Where Your Insurance Dollar Goes.’ The one word below it: ‘Surprised?’

“We’re told,” Potter writes, “that the sponsor of the ad is rethinkreform.com, meaning that it is the work of a front group within a front group. Berman’s ‘Institute’ created The Committee to Rethink Reform in 2009 to stir up opposition to the health care law.”

Potter gives us an interesting look at the history of health insurance in the story.

“Back in the early 1990s, when most insurance firms were still nonprofits, they were spending on average 95 cents of every premium dollar paying medical claims. As they began to convert to for-profit status, though, that percentage dropped because of pressure from Wall Street. Now that the industry is dominated by a handful of investor-owned corporations, the average is around 80 percent. The members of Congress who drafted The Affordable Care Act felt that was as low as it should go. And so they inserted language in the bill requiring insurers to pay rebates to their policyholders if they go below that threshold.”

Makes sense to me.

“Shareholders hate that provision,” Potter says, “because the less insurance companies spend on health care, the more is available for profits. And because job number one for any investor-owned company is to “enhance shareholder value,” industry lobbyists have been at work ever since the bill’s passage to get the provision repealed or weakened. One way of doing that is by getting Congress to exempt the commissions insurance firms pay agents who sell their policies from the equation used to determine that threshold. The House Energy and Commerce Committee is set to do that as early as [April 16].”

So, who is Wendell Potter and why should we believe him? Well, he’s a former executive and whistle-blower for CIGNAhealth insurance and the author of Deadly Spin: An Insurance Company Insider Speaks out on How Corporate PR is Killing Health Care and Deceiving Americans.

“Because it is a 501(c)4 organization,” Potter continues, “The Employment Policies Institute does not have to disclose where it gets its funding—and it doesn’t. But knowing just what lobbying and PR group paid a consulting firm to create that divided dollar bill several years ago should give us a pretty good hint. It was none other than—you guessed it—the lobbying and PR group for the insurance industry, America’s Health Insurance Plans.

“AHIP has commissioned the consulting firmPricewaterhouseCoopers to develop a number of “studies” over the years to help advance whatever agenda AHIP felt needed advancing. With a tagline, ‘Your agenda is our agenda,’ PwC has a proven track record of being a reliable agenda advancer for AHIP.

“So reliable, in fact, that it put out a widely discredited AHIP-commissioned study a few weeks before the Senate voted on reform in 2009 in an attempt to get people to believe that certain provisions of the reform bill would raise premiums. PwC was forced to disavow the study’s conclusions when reporters figured out that AHIP had instructed it to ignore other important provisions of the bill that would help hold premium costs down.

“I was still working for the industry,” Potter adds, “when AHIP hired PwC to come up with that dollar bill that now graces Washington’s subway cars. Berman’s subway ad uses the exact numbers, down to the penny, that were featured on the AHIP/PwC dollar.

“When we see that dollar and its cost breakdowns, what’s really supposed to surprise us is that just 3 cents go to health insurer profits. What AHIP/PwC and Berman’s groups don’t tell you is that the big for-profit insurers make far more than 3 cents profit off of every premium dollar they collect from us, and that the only way they were able to get the average down to 3 cents was by including several nonprofit insurers—the ones that cannot by law make a profit—in the equation.

“AHIP thought up the dollar bill illusion to obscure the reality of just how profitable insurers really are. Over just the past two years, the five biggest insurers have reported more than $20 billion in profits. That’s money that could be used to provide millions of uninsured Americans access to needed care.”

Look, I won’t kid you, I’m still sifting through the pros and cons of health care – attempting to separate the truth from the fiction, as all of us should. The ethical bottom line: whether you are for or against the health care law, let’s all please check the facts. One of many interesting articles comes from co-authors Dan Bednarz, Ph.D., and Jessica Pierce, Ph.D. in a 2009 article entitled, The Ethics of Sustainable Healthcare Reform.

Comments