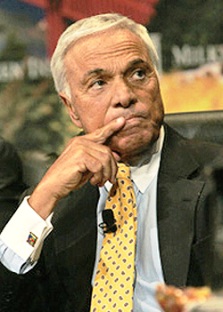

The fallout surrounding Countrywide Financial and Chief Executive Angelo R. Mozilo just keeps getting worse. The last 42-days have seen an extraordinary amount of activity.

On May 15, Federal District Court Judge Mariana Pfaelzer said that “…she found confidential witness accounts in the shareholder complaint to be credible… they suggested, ‘a widespread company culture that encouraged employees to push mortgages through without regard to underwriting standards.’”

Blair Nicholas, one of two lawyers representing the plaintiffs said, “It is a critical step enabling Countrywide and its shareholders to hold accountable the officers and directors who looted the company and were responsible for its devastating collapse.”

The New York Times reported, “The plaintiffs contend that the directors and officers dumped shares even as the company spent $2.4 billion to repurchase its own stock in late 2006 and early 2007.” And that, in particular, Chief Executive Angelo Mozilo’s personal stock sale of $474, although legal, has been questioned by plaintiffs seeking to recover money for shareholders.

On June 25, Washington state Governor Christine Gregoire plans to “address allegations of repeated discriminatory lending practices” by Countrywide.

Later that same day, Illinois Attorney General Lisa Madigan announced that her state would be suing Countrywide Financial and Angelo R. Mozilo, “…contending that the company and its executives defrauded borrowers… by selling them costly and defective loans that quickly went into foreclosure.”

On June 26, California Attorney General Jerry Brown announced the state would join Illinois in suing Countrywide and Mr. Mozilo, accusing “…the lender of engaging in unfair trade practices that encouraged homeowners to take out risky loans, regardless of whether they could repay them.”

On June 14, we learned that Senators Kent Conrad, (D) of North Dakota, and Christopher Dodd, (D) of Connecticut, became the center of inquiry due to their participation in what is referred to as Countrywide’s “V.I.P” program, also known as the “Friends of Angelo” program.

When he wanted a mortgage for his beach house, Senator Conrad turned to Washington insider James Johnson the former head of Fannie Mae. Johnson linked Conrad with Mozilo. “The ensuing telephone call,” the Times reported, “between Mr. Conrad and Mr. Mozilo led to two Countrywide mortgages, including one in which the company bent its rules to give Mr. Conrad a loan.”

Senator Dodd, chairman of the Senate Banking Committee, and quite vocal in trying to help homeowners caught in the mortgage crisis, denied that he received any preferential treatment for two Countrywide loans.

“As a United States senator,” Dodd said, “I would never ask or expect to be treated differently than anyone else refinancing their home. …Just like millions of other Americans, we shopped around and received competitive rates.”

“But Portfolio.com,” the New York Times reported, “cited internal documents indicating that Countrywide had reduced the rate on the mortgage of Mr. Dodd’s Washington town house by three-eights of a point, saving him $2,000 a year in interest payments, and reduced the rate on a Connecticut house by a quarter point, saving $17,000 over the life of the loan.” (It should be pointed out that neither Dodd nor his wife ever spoke with Mr. Mozilo about their loans.)

“In the case of Mr. Conrad,” the Times said, “…Portfolio.com cited Countrywide memorandums in which Mr. Mozilo told an employee to ‘make an exception due to the fact that the borrower is a senator.’ That exception applied to a mortgage for an eight-unit apartment building in Bismarck, N.D., that Mr. Conrad was buying… For Mr. Conrad’s $1.07 million mortgage on his home in Bethany Beach, Del., Mr. Mozilo sent an e-mail message directing an employee to ‘take off 1 point,’ or reduce the interest rate by a percentage point.”

Countrywide’s web site states, “We specialize in finding ways to say “Yes!”

No argument there.

Comments