Last month’s revelation that the Internal Revenue Service wrongly targeted conservative groups who applied for tax exempt status under Section 501(c)(4) of the U.S. Tax code has done much to play into the conventional wisdom that the IRS does, indeed, target individuals and groups based on politics.

Let me start by explaining to those readers who may be first-time visitors that the purpose of this site is to examine contemporary issues through an ethical lens using both ethical values and facts. When a story as politically-charged as the IRS scandal comes along, there is a tendency by many in the public, (with abundant help from pundits and cable channels), to initially jump to a great many conclusions based on political bias.

This issue seems to center around three questions: what happened, who’s responsible, and is there any evidence of a connection between the clearly wrong-headed actions of IRS officials and the White House?

In looking at this issue, context – the set of facts and circumstances surrounding an event – is important. So, let’s begin with a little history.

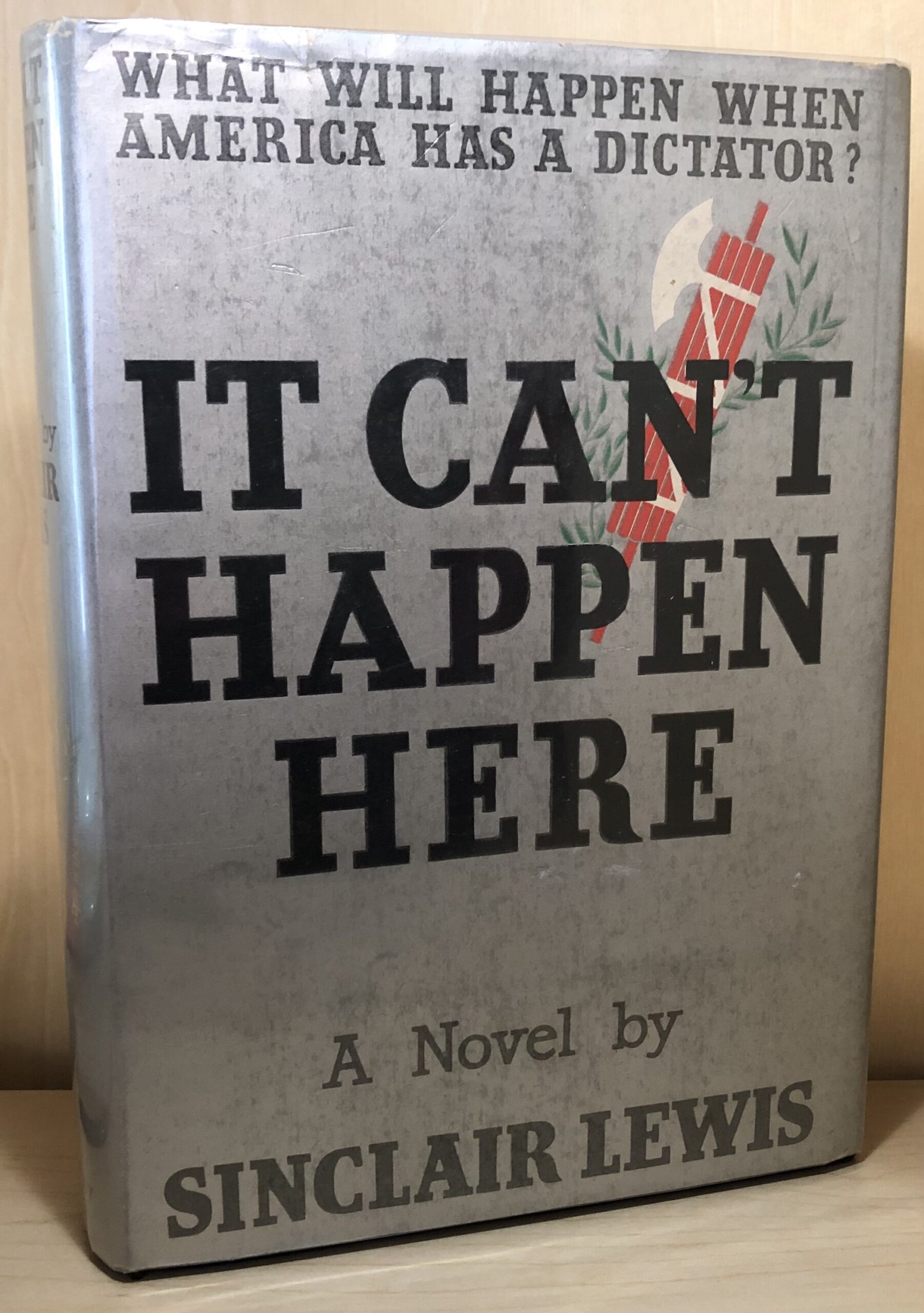

On January 21, 2010, the Supreme Court held (Citizens United v. Federal Election Commission) that “Political spending is a form of protected speech under the First Amendment, and the government may not keep corporations or unions from spending money to support or denounce individual candidates in elections. While corporations or unions may not give money directly to campaigns, they may seek to persuade the voting public through other means, including ads, especially where these ads were not broadcast.”

In September of that year, The New York Times reported that “Crossroads Grassroots Policy Strategies would certainly seem to the casual observer to be a political organization… it has spent millions of dollars on television commercials attacking Democrats in key Senate races across the country. Yet the Republican operatives who created the group earlier this year set it up as a 501(c)(4) nonprofit corporation, so its primary purpose, by law, is not supposed to be political.

“The rule of thumb,” The Times writes, “in fact, is that more than 50 percent of a 501(c)(4)’s activities cannot be political. But that has not stopped Crossroads and a raft of other nonprofit advocacy groups like it — mostly on the Republican side, so far — from becoming some of the biggest players in this year’s midterm elections, in part because of the anonymity they afford donors, prompting outcries from campaign finance watchdogs. …

” ‘I can tell you from personal experience, the money’s flowing,’ said Michael E. Toner, a former Republican F.E.C. commissioner, now in private practice at the firm Bryan Cave.

” ‘The Supreme Court has completely lifted restrictions on corporate spending on elections,’ said Taylor Lincoln, research director of Public Citizen’s Congress Watch, a watchdog group. ‘And 501(c) serves as a haven for these front groups to run electioneering ads and keep their donors completely secret.’

“The I.R.S. division with oversight of tax-exempt organizations ‘is understaffed, underfunded and operating under a tax system designed to collect taxes, not as a regulatory mechanism,’ said Marcus S. Owens, a lawyer who once led that unit and now works for Caplin & Drysdale… ‘These groups are popping up like mushrooms after a rain right now, and many of them will be out of business by late November,’ Mr. Owens said. ‘Technically, they would have until January 2012 at the earliest to file anything with the I.R.S. It’s a farce.’

Three days later (Sept. 23), The Times reported this story (Hidden Under Tax-Exempt Cloak, Political Dollars Flow):

“Alaskans grew suspicious two years ago when a national organization called Americans for Job Security showed up and spent $1.6 million pushing a referendum to restrict development of a gold and copper mine at the headwaters of Bristol Bay. …

“But after the mine’s supporters filed a complaint with the state, it became clear that… Americans for Job Security, investigators found, had helped create the illusion of a popular upwelling to shield the identity of a local financier who paid for most of the referendum campaign. More broadly, they said, far from being a national movement advocating a ‘pro-paycheck message,’ the group is actually a front for a coterie of political operatives, devised to sidestep campaign disclosure rules.

” ‘Americans for Job Security has no purpose other than to cover various money trails all over the country,’ the staff of the Alaska Public Offices Commission said in a report last year. …

“Americans for Job Security avoids disclosure by reporting all its revenue as ‘membership dues.’ It claims more than 1,000 members. But a review of its tax returns shows membership revenue fluctuating wildly depending on election cycles — similar to the fund-raising of political committees that escalates during campaign season.

” ‘Membership dues and assessments’ totaled $7 million in the 2004 presidential election, and dipped to $1.2 million the following year before climbing back to $3.9 million for the 2006 midterm elections. Then, in 2007, they plunged to zero before shooting up to $12.2 million for the 2008 presidential race.”

Not long after The Times stories appeared, Senator Max Baucus, the Democratic chair of the Senate Finance Committee, asked the IRS to examine and ensure that 501(c)(4) nonprofits were fully complying with IRS tax rules. Republican Senators Orrin Hatch and John Kyl, concerned about a possible First Amendment violation with such an investigation, asked the Treasury Department’s non-partisan Inspector General to review the issue.

In February, 2012, a group of Democratic Senators wrote to then IRS Commissioner Douglas Shulman, a George W. Bush appointee: “We urge you to protect legitimate section 501(c)(4) entities by preventing non-conforming organizations that are focused on federal election activities from abusing the tax code.”

In addition, the group asked the IRS to clearly define the amount of political activity is permissible for “social welfare” groups under 501(c)(4).

According to a report in The Wall Street Journal (May 12, 2013), groups organized under “…501(c)(4) of the Internal Revenue Code are allowed to engage in some political activity, but the primary focus of their efforts must remain promoting social welfare. That social-welfare activity can include lobbying and advocating for issues and legislation, but not outright political-campaign activity. But,” the Journal points out, “some of the rules leave room for IRS officials to make judgment calls and probe individual groups for further information.”

During the period between 2010 and 2012, the IRS reported that the number of applications for 501(c)(4) status doubled. During that time, Congress reduced the IRS budget from $12.1 billion to $11.8 billion. “This,” The New York Times wrote in January, 2012, “is causing the I.R.S. to resort to shortcuts that undermine fundamental taxpayer rights and harm taxpayers…”

Last month saw the convergence of all these contributing factors whereby IRS officials in the Cincinnati field office came up with the remarkably shortsighted shortcut of flagging potentially suspicious groups with names like “Tea Party,” “Patriot,” “9/12 Project,” “Constitution,” etc..

However, the May 12, 2013 Wall Street Journal story reported that the IRS’s “scrutiny of conservative groups went beyond those with ‘tea party’ or ‘patriot’ in their names—as the agency admitted Friday—to also include ones worried about government spending, debt or taxes, and even ones that lobbied to ‘make America a better place to live,’ according to new details of a government probe. …

“The investigation also revealed that a high-ranking IRS official knew as early as mid-2011 that conservative groups were being inappropriately targeted—nearly a year before then-IRS Commissioner Douglas Shulman told a congressional committee the agency wasn’t targeting conservative groups.”

Shulman continued to stress that 501(c)(4) groups, while permitted to engage in some political activity, the “primary focus of their efforts must remain promoting social welfare.”

Shulman resigned his post before the scandal was brought to light by an inspector general’s report.

TOMORROW – what did that report find and where do we stand in answering the three questions I posed.

Comments