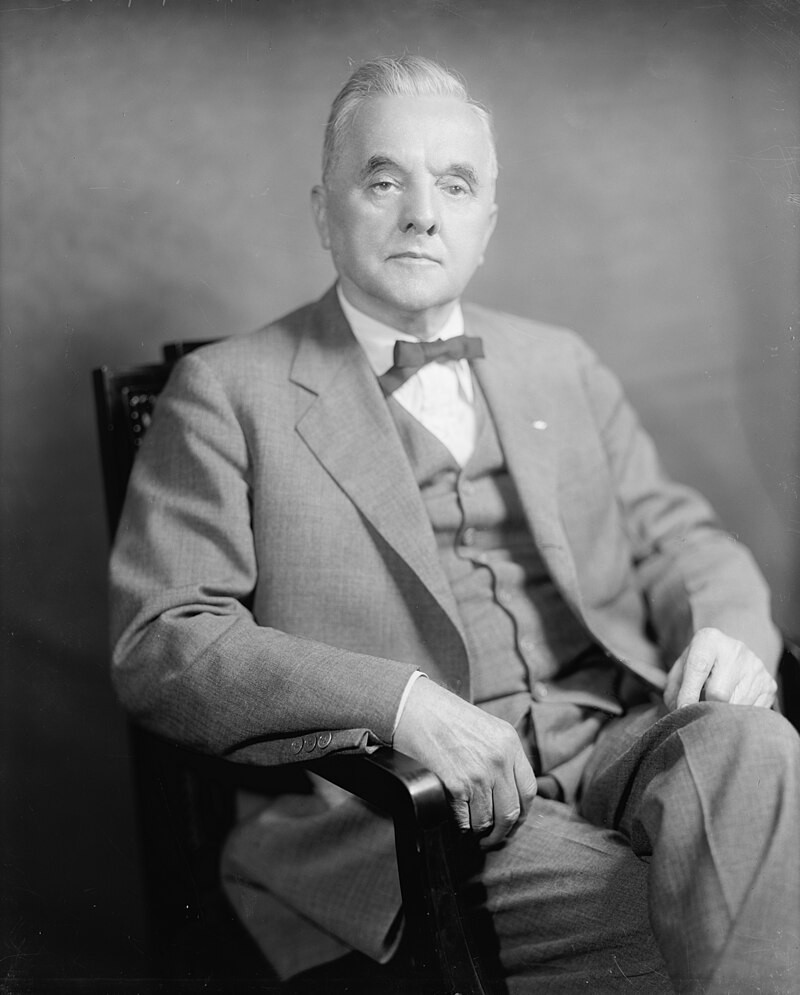

“September 2005,” former AIG investment specialist Gordon Massie writes, “…the atmosphere at AIG was still toxic and oppressive.”

Of course, the real dilemma for any whistleblower is what happens after you report something wrong? Are the people at the top willing to accept and act on the information you uncover or are they out to bury it… and you?

What followed for Gordon Massie was not-so-subtle retaliation. Over the course of weeks and months “…my workload had been reduced to little, if any, meaningful work. Seventy percent of my responsibilities were gone… After a while,” Massie writes, “it seemed like AIG was paying me a sizable amount of compensation and $120,000 extra a year to keep me in New York just so they could publicly humiliate me…

“But what could I do? I knew it was retaliation but could I prove it?”

Working with attorney Jonathan Sack, Massie put together a strategy whereby Massie would present a one-inch binder of evidence to AIG’s attorneys. If AIG failed to meet the right terms of a severance agreement, Massie would turn his information over to a reporter at The Wall Street Journal. After an alternative proposal was agreed upon, the insurance giant accepted the deal rather than face additional scrutiny in the press.

“This was the cost of doing business the way AIG did business…. There were no ethics or moral issues at stake here. Just raw business,” Massie writes. “Just an impersonal severance agreement and the silent exchange of big dollars. There was no remorse, no recognition of any wrongdoing, and no looking back by AIG.

“I was the one who, oddly enough, began to feel the remorse,” Massie says. “Shouldn’t I have stood my ground and gone public with my allegations? Shouldn’t I have allowed the public to truly see inside AIG the way I had? Wouldn’t the world be a slightly better place if I had filed my case with the Department of Labor and the whole world could know of AIG’s dirty secrets?

“…when I was finally offered my settlement I was a complete emotional wreck. Anxiety and depression had depleted my will to fight. While these were my immediate concerns at the time, I soon realized that there was nothing in my settlement agreement with AIG that precluded me from telling my story publicly, as long as I did not reveal any confidential AIG information or any of the dollar terms of the settlement.”

This, of course, led to Massie’s invigorating book, The Whistleblower’s Dilemma.

What is finally realized in the chaos and emotional turmoil involved with any individual acting on his or her ethical conscience is the reality that not only is their job gone, but their career, as well. Ask tobacco insider Jeffrey Wigand,WorldCom’s Cynthia Cooper or the FBI’s Colleen Rowley, as I have. After the dust settles, (along with any settlement, if they get one and they usually don’t) they’re left on the outside of whatever meaningful careers they once enjoyed.

“My working world had been filled with so much before it all blew up,” Massie writes. “When I walked into rooms… conversations stopped. I controlled billions of dollars… My decisions had pronounced ripple effects on people, companies, and AIG.”

Massie concludes that “AIG failed for the following reasons:

- AIG was far too large and geographically and operationally diverse.

- AIG was too disorganized without reasonable systems and controls.

- Within AIG there was a culture that tolerated fraud and corruption.

- Weak management depth caused by years of dominator by Hank Greenberg.

“The basic cause… of all these corporate collapses has been the unbridled human greed and arrogance displayed by the senior managements of these companies.

“What can we learn from AIG’s collapse? …Certainly there will be plenty of new regulations for financial institutions to adhere to in the future… but there will always be business failures in our future since these are tied into the web of capitalism and are difficult to prevent simply through additional regulations.”

Considering Massie’s experience and additional ethical lapses on Wall Street, I asked Gordon to give me a list of “warning signs” of possible corruption investors should look out for:

- Frequent and large company earnings restatements

- Weak management systems and controls (systems capital expenditures too low)

- Numerous acquisitions (more opportunities for “creative” accounting)

- High employee turnover and low morale (what are the bloggers saying?)

- Dictatorial and long term CEO

- Passive Board of Directors (insiders)

- Frequent litigation

- Heavy use of stock options for management compensation

- Unknown or small auditing firm

- Unusually complex financial statements

Currently, Gordon Massie spends much of his time involved a variety of volunteer work. Oh, and one other career choice – speaking on ethics to students at colleges and universities around the country; a job not only meaningful but critically needed today.

For more information, go to www.aigwhistleblower.com

Comments