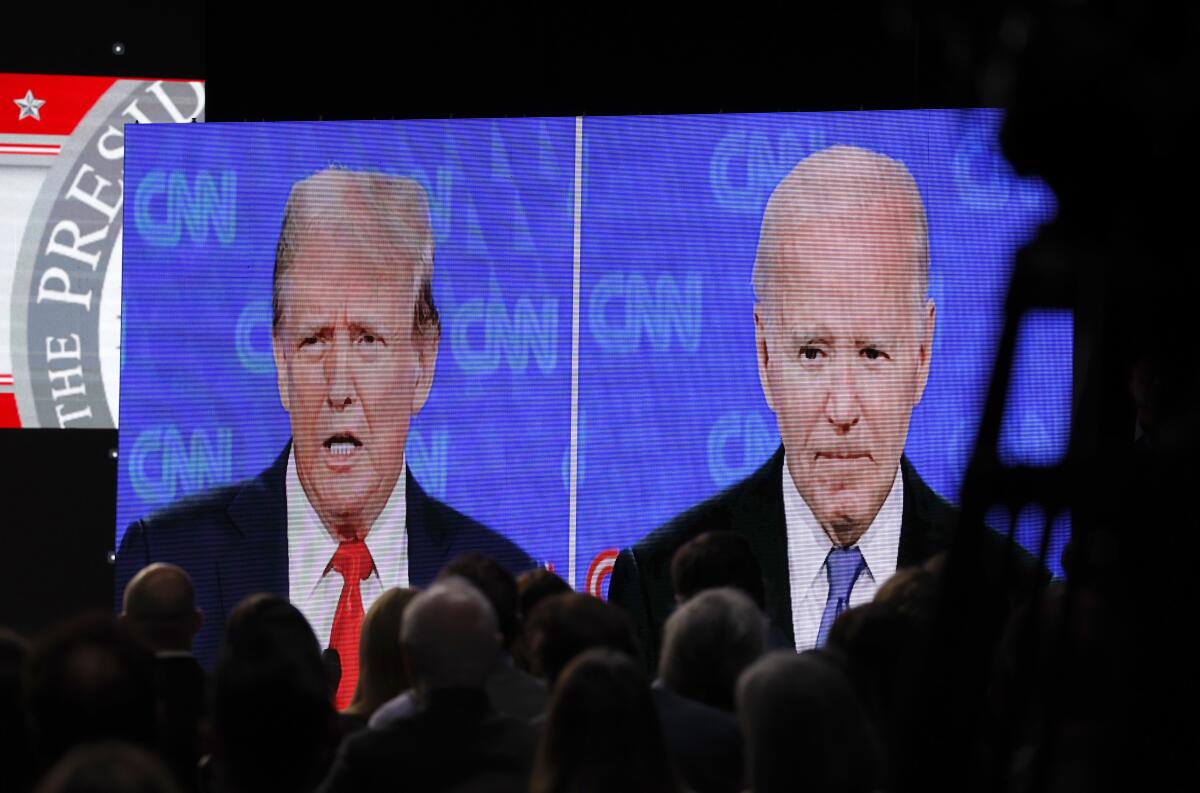

I’ve written before how, in an effort to be first, some journalists will report on a story without thoroughly checking a number of source points. However, when the story is reported live, in the middle of an ongoing crisis, the consequences to one’s credibility can be harsh.

CNN National Correspondent John King’s credibility came into question when he was one of the first to report, mistakenly, that a suspect had been arrested in the Boston Marathon bombing two days after the attack. I like King, respect his work. He’s proven himself in the past as a journalist who not only does his homework, but has learned how to separate fact from speculation. Having said that, King made a mistake. Here’s how he explained it to D.C. radio station WTOP:

“We had two reputable sources, one of mine and one of a colleague of mine, who have been reputable in the past who simply had bad information. We went with it and we had to correct it.”

King added that the error was personally and professionally upsetting to him because he comes from Boston. “It’s my city, too, so it’s sort of a double kick in the head to me. But, the best way to deal with it is to say ‘We made a mistake. Here’s how we made a mistake.’ And then move on.”

It makes little difference that Fox News, The Boston Globe and The Associated Press reported the same misinformation. If you’re a CNN viewer, you’re going to look to the credibility of the first person who tells you the story.

“In the age of the perpetual news cycle, scoops are only scoops for a matter of seconds – minutes at the most,” says Tom Rosenstiel, past director of The Project for Excellence in Journalism.

While we esteem ourselves for having a free and open press, the power of that press should always be treated as a public trust, as such, conscientious journalism must include the quality of self-restraint – something easier said than done when ratings points mean more or less advertising dollars.

Whenever it’s been pointed out to me how much it costs to double-check sources or fact-check stories, I respond by asking, “How much is your reputation worth?”

Rosenstiel and journalist Bill Kovach co-authored a useful book entitled The Elements of Journalism. They discuss five principles involved in the science of reporting: “1) Never add anything that was not there; 2) Never deceive the audience; 3) Be transparent as possible about your methods and motives; 4) Rely on your own original reporting; and 5) Exercise humility.”

When I compare these principles to King’s reporting misstep, I believe he honestly utilized all of them. The problem was that his source, and that of his colleague’s, were simply wrong. The way he handled it was correct: explain what happened, apologize to your audience and move on, with one caveat:always strive to do better next time.

This brings me to the highjacking of The Associated Press’s Twitter feed.

On Tuesday, Wall Street went into a tailspin, abruptly dropping some 150 points based on a tweet from the AP which falsely claimed that two explosions had occurred at the White House and that President Obama had been injured.

The New York Times reported (April 25), that “A group calling itself the Syrian Electronic Army claimed responsibility for the attack on Twitter, but the Federal Bureau of Investigation is investigating who was behind the attack, and the Securities and Exchange Commission and the Commodity Futures Trading Commission are investigating the impact of the attacks on the market.”

But that’s not what bothers me most about this story.

“High-frequency trading algorithms,” The Times noted “that are designed to make trades based on certain headlines served as a catalyst.”

Apparently, sophisticated computer programs were responsible for reacting and bringing down the markets. Fortunately, cooler heads – namely, real people – prevailed, and the markets began to recover within five minutes. Nonetheless, action to prevent another false crisis needs to be taken on two fronts:

First, news sources need to implement a more rigorous protocol to protect their systems from hackers; protocols that should be continuously monitored and updated. Secondly, the markets, themselves, need to institute a more robust system of checks and balances.

“John Chilton, a commissioner with the [Commodity Futures Trading Commission], told CNBC Wednesday that ‘We need certain rules of the road for technology and that’s particularly true with the advent of social media.’

“Mr. Chilton, who referred to high frequency traders as ‘cheetahs,’ noted that there was no ‘kill switch’ in their technology to prevent them from acting on misinformation. ‘We need to set up basic rules of the road,’ Mr. Chilton said. ‘We should not just accept technology blindly.’ ”

Human mistakes will happen, but, in the case of John King, the reporter came back, explained the situation and apologized. Algorithms — as of this writing — aren’t programmed to apologize. However, the humans that created those algorithmsshould adopt procedures similar to the “curbs” that are activated when markets react to bad news. It’s a breaking system that deliberately slows trades to prevent panic selling.

While the merging of information and technology is becoming more routine, each is only good as the individuals that responsibly use them.

Comments