That’s the term used to describe undisclosed funds that are used to help pay for an election campaign without the voter knowing who donated the money prior to an election.

A report from The Center for Public Integrity (Feb. 27), a non-profit investigative journalism group revealed that “Two of the tightest races for U.S. Senate in 2012 were in Nevada and Arizona. Republican candidates eked out wins in both states with help from four so-called ‘dark money’ nonprofits.

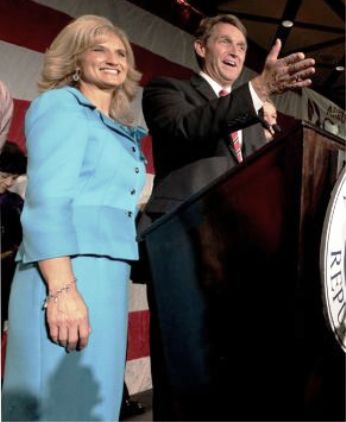

“Then-Representative Jeff Flake of Arizona and incumbent Senator Dean Heller of Nevada benefited from $3.1 million in spending by the groups. Voters in the states had no idea who was funding the attacks because the organizations were not required to reveal their donors.

“Adding insult to injury for the Democratic contenders, Shelley Berkley in Nevada and Richard Carmona in Arizona, it turns out one of the groups’ nonprofit benefactors explicitly warned them not to spend the money on that sort of politicking.”

The Center identified four nonprofits in the scheme: Americans for Responsible Leadership, American Future Fund, American Commitment and Americans for Tax Reform. The fact that these groups were able to donate undisclosed funds for political purposes without any consequences, demonstrates how little oversight given “in the wake of the 2010 U.S. Supreme Court decision that has allowed them to flourish,” the report says.

In Citizens United v. Federal Election Commission, the Supreme Court held that “…the First Amendment prohibits the government from restricting political independent expenditure by corporations, associations or labor unions.” To fully understand the consequences of this, it’s important to recognize that a single American citizen is allowed by law, to contribute $2,600 “to each candidate or candidate committee per election,” the FEC says. However, a 501(C)(4) nonprofit is permitted by law, to raise and spend unlimited amounts of money from corporations, unions, associations and individuals to support or oppose any candidate or issue.

So, if you’re Joe Schmo and want to contribute to a candidate, you write you check for $2,600 to either the candidate or committee set-up by the candidate. But if you’re billionaires David and Charles Koch, you can give an unlimited amount of money by way of a 501(c)(4).

According to a heavily footnoted item in Wikipedia, “501(c)(4) organizations are generally civic leagues and other corporations operated exclusively for the promotion of ‘social welfare,’ such as civics and civics issues, or local associations of employees with membership limited to a designated company or people in a particular municipality or neighborhood, and with net earnings devoted exclusively to charitable, educational, or recreational purposes.”

Unfortunately, the term “social welfare” is so broadly defined that it has led to a number of these groups using funds to not only engage in lobbying efforts, but directly fund political campaigns. Oh, and they’re not required to reveal who their donors are.

The Center for Public Integrity revealed that “The group that supplied some of the funds for the four groups’ [Americans for Responsible Leadership, American Future Fund, American Commitment and Americans for Tax Reform] political spending was the Center to Protect Patient Rights — which is basically a mailbox and a bank account. The group, effectively financed by billionaire brothers Charles and David Koch and like-minded conservatives, has acted as a sort of bank distributing cash to political nonprofits.

“In its tax return, the nonprofit Center to Protect Patient Rightsnotes that it ‘carefully evaluates the missions and activities of recipient organizations prior to making any grants to ensure that funds are used only for tax-exempt education and social welfare purposes.’

“It adds: ‘Grants are accompanied by a letter of transmittal indicating how grant funds may be used.’

“But a Center for Public Integrity review of Internal Revenue Service and Federal Election Commission documents shows that the four groups involved in the Nevada and Arizona races received almost $79 million, or most of the $112 million theCenter to Protect Patient Rights doled out. What’s more, they spent some of the non-political grants they received on political campaigning. Yet there are no known repercussions.

“Lax IRS rules and weak oversight may be to blame, according to interviews in December with a half-dozen nonprofit attorneys.

“Some nonprofit attorneys say the nonprofit grantees could get in trouble for not following their donors’ wishes. A state attorney general, for example, could go after such groups and the IRS could follow suit, said James Joseph, a nonprofit attorney and a partner at Arnold & Porter. ‘The IRS can take away tax-exempt status if a nonprofit violates a non-tax law; so here the IRS might argue the grantee is violating state law relating to donor intent,’ he wrote in an email.”

The CPI says that “The IRS is mulling whether to beef up its rules on political activity by nonprofits that aren’t required to reveal their donors. ‘Social welfare’ nonprofits, known as 501(C)(4) groups, and 501(C)(6) trade associations have played an outsized role in federal elections since the Supreme Court’s Citizens United decision…

“The proposed IRS rules would more clearly define political expenses for social welfare nonprofits,” the Center reports, “making them less likely to mis-report political expenses to the IRS, and would effectively bar the groups from using social welfare grants on political activity. But opposition to key parts of the proposal from both liberals and conservatives could kill it, at least in its current form.

“Adam Rappaport, senior counsel of Citizens for Responsibility and Ethics in Washington, argues that ‘dark money’ groups should go further by reporting the true sources of funding for their political expenses.

“The public should know,” Rappaport said, “who is paying for political ads that can sway elections.”

Comments